8 Lookup of symbols and codes

A list of symbols and lookup codes that match a specified set of criteria can be retrieved using the 'lookup' and 'chain' actions. Various different lookups can be requested, which differ by the DataType parameter.

8.1 Symbols lookup

To retrieve a list of symbols that match certain criteria, set the action to 'lookup', DataType to 'symbols' and add one or more filtering criteria: Name, Description, Market, SecType, SIC, and/or NAICS:

>> data = IQML('lookup', 'DataType','symbols', 'Name','IBM')

data =

1086×1 struct array with fields:

Symbol

Description

Market_ID

Market_Name

Sec_Type_ID

Sec_Type

>> data(1)

ans =

Symbol: 'IBM'

Description: 'INTERNATIONAL BUSINESS MACHINE'

Market_ID: 7

Market_Name: 'New York Stock Exchange (NYSE)'

Sec_Type_ID: 1

Sec_Type: 'Equity'

>> data(2)

ans =

Symbol: 'IBMG'

Description: 'ISHARES IBONDS SEP 2018 MUNI BOND'

Market_ID: 11

Market_Name: 'NYSE Archipelago (NYSE_ARCA)'

Sec_Type_ID: 1

Sec_Type: 'Equity'

>> data(9)

ans =

Symbol: 'IBM1804E120'

Description: 'IBM MAY 2018 C 120.00'

Market_ID: 14

Market_Name: 'OPRA System'

Sec_Type_ID: 2

Sec_Type: 'Index/Equity Option'

>> data(end)

ans =

Symbol: 'IBZ18-IBM19'

Description: '30 DAY INTERBANK CASH RATE DEC 18/JUN 19'

Market_ID: 64

Market_Name: 'ASX24 Commodities Exchange (ASXCM)'

Sec_Type_ID: 10

Sec_Type: 'Future Spread'

IQFeed returns a list of symbols whose symbol name contains (not necessarily begins with) the term 'IBM', from different markets (exchanges) and different security types.

Note that the Name and Description filtering criteria are case-insensitive (so 'IBM', 'Ibm' and 'ibm' would all result in the same list of symbols), and also that they match their string value anywhere within the corresponding asset field.

You can narrow-down the results by entering more-specific parameter values (e.g. 'IBM180' rather than 'IBM'), or by specifying additional filtering parameters. For example, to filter the IBM list just to assets that include ‘business’ in their Description:

>> data = IQML('lookup', 'DataType','symbols', 'name','ibm', ...

'Description','business')

data =

8×1 struct array with fields:

Symbol

Description

Market_ID

Market_Name

Sec_Type_ID

Sec_Type

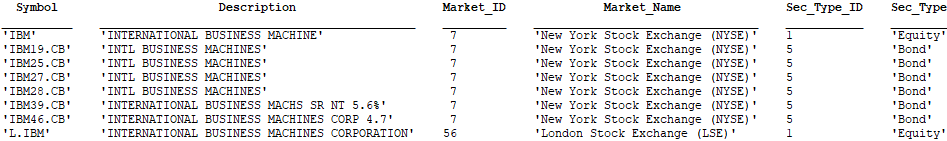

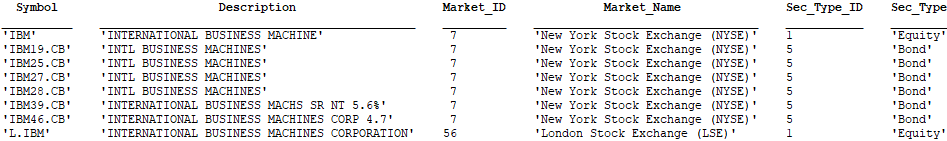

>> data = struct2table(data)

data =

8×6 table

Unlike the Name and Description (which match strings), the SIC and NAICS parameters are numeric and match the beginning of the corresponding SIC/NAICS sector/industry code. For example, the following query returns all assets that have 'inc' in their Description and belong to any sector whose SIC code begins with 83:139

>> data = IQML('lookup', 'DataType','symbols', 'Description','inc', 'SIC',83)

data =

6×1 struct array with fields:

Symbol

Description

Market_ID

Market_Name

Sec_Type_ID

Sec_Type

SIC_ID

SIC_Desc

>> data(1)

ans =

Symbol: 'HQGE'

Description: 'HQ GLOBAL ED INC'

Market_ID: 3

Market_Name: 'Nasdaq other OTC'

Sec_Type_ID: 1

Sec_Type: 'Equity'

SIC_ID: 8331

SIC_Desc: 'JOB TRAINING AND VOCATIONAL REHABILITATION SERVICES'

>> disp({data.Symbol; data.Description; data.SIC_ID; data.SIC_Desc}')

'HQGE' 'HQ GLOBAL ED INC' [8331] 'JOB TRAINING AND ...'

'KVIL' 'KIDVILLE INC' [8351] 'CHILD DAY CARE SERVICES'

'DRWN' 'A CLEAN SLATE INC.' [8361] 'RESIDENTIAL CARE'

'NVOS' 'NOVO INTEGRATED SCIENCES INC...' [8361] 'RESIDENTIAL CARE'

'SPRV' 'SUPURVA HEALTHCARE GROUP INC...' [8361] 'RESIDENTIAL CARE'

In this example, to retrieve just the 3 symbols in the Residential Care industry, set the SIC value to the industry’s specific SIC code (8361), rather than its sector code (83).

When you specify a SIC or NAICS filtering criteria, the result contains two additional fields (either SIC_ID and SIC_Desc, or NAICS_ID and NAICS_Desc, respectively), in addition to the standard fields (Symbol, Description, Market_ID, Market_Name, Sec_Type_ID and Sec_Type).140

Note that it is possible that not all the requested symbols will be received before IQML’s timeout (default value: 5 secs) returns the results:141

>> data = IQML('lookup', 'DataType','symbols', 'Name','GOOG')

Warning: IQML timeout: only partial data is returned. Perhaps the Timeout parameter should be set to a value larger than 5

data =

3848×1 struct array with fields:

Symbol

Description

Market_ID

Market_Name

Sec_Type_ID

Sec_Type

To control the maximal duration that IQML will wait for the data, set the Timeout parameter. For example, to wait up to 30 secs to collect the complete list of symbols:

>> data = IQML('lookup', 'DataType','symbols', 'Name','GOOG', 'timeout',30)

data =

11562×1 struct array with fields:

...

In addition to Timeout, for long queries it is advisable to set the Progress parameter to 'console', in order to display a periodic progress update message in the console every 1000 data points (every ~1-2 secs), as well as at the end of the query:

>> data = IQML('lookup', 'DataType','symbols', 'Name','GOOG', 'timeout',-1,...

'progress','console');

1000 lookup symbols processed. Latest: GOOG2112N1460 ...

2000 lookup symbols processed. Latest: GOOG2116G1520 ...

3000 lookup symbols processed. Latest: GOOG2119B900 ...

4000 lookup symbols processed. Latest: GOOG2122M1822.5 ...

...

11562 lookup symbols processed

Naturally, it is quite possible that no symbol is found that matches the requested criteria. In such a case, the result will be empty (and cannot be displayed using Matlab’s struct2table() or struct2cell() functions):

>> data = IQML('lookup', 'DataType','symbols', 'Description','inc', 'NAICS',83)

data =

[]

>> struct2cell(data)

Undefined function 'struct2cell' for input arguments of type 'double'.

An error message will result if you try to specify both SIC and NAICS filtering criteria – only one (or none) of them is permitted in a lookup query:

>> data = IQML('lookup', 'DataType','symbols', 'NAICS',1234, 'SIC',83)

You can specify either SIC or NAICS parameter, but not both of them, in a symbol lookup query

An error message will also result if you do not specify at least one of the filtering criteria Name, Description, Market, SecType, SIC, NAICS:

>> data = IQML('lookup', 'DataType','symbols')

At least one of Name, Description, Market, SecType, SIC or NAICS parameters must be specified in a symbol lookup query

You can filter the results based on one or more markets, and/or security types, using the Market and SecType parameters (see §8.3, §8.4 for valid values). For example:

>> struct2table(IQML('lookup', 'datatype','symbols', 'name','GOOG', 'SecType','Equity'))

ans =

2×6 table

Symbol Description Market_ID Market_Name Sec_Type_ID Sec_Type

_______ ______________________ _________ ________________ ___________ ________

'GOOG' 'ALPHABET INC CLASS C' 21 'Nasdaq Global Select Market (NGSM)' 1 'Equity'

'GOOGL' 'ALPHABET INC CLASS A' 21 'Nasdaq Global Select Market (NGSM)' 1 'Equity'

>> data = IQML('lookup', 'datatype','symbols', 'name','GOOG', 'Market','NGSM');

Multiple Markets and/or SecTypes142 can be specified using a cell array. For example, to get the list of all active (non-expired) GOOG equities and options:143

>> data = IQML('lookup', 'datatype','symbols', 'name','GOOG', ...

'SecTypes',{'Equity','IEOption'}, 'Timeout',20)

data =

8056×1 struct array with fields:

Symbol

Description

Market_ID

Market_Name

Sec_Type_ID

Sec_Type

You can specify both Market(s) and SecType(s) to get an even more granular filtering. For example, to lookup only future options traded on CBOT:

>> data = IQML('lookup', 'datatype','symbols', 'name',symbol, ...

'SecTypes','FOption', 'Markets','CBOT');

Similarly, to lookup VIX (volatility) futures and future-spreads (but not combined future volume OI symbols such as @VX1.OI.Z) on the CBOE Futures Exchange (CFE):

>> data = IQML('lookup', 'datatype','symbols', 'name','vx', ...

'SecTypes',{'Future','Spread'}, 'Markets','CFE');

If you specify one or more invalid Market(s) or SecType(s), you will get an error. For example, a typical error is to specify a SecType of 'Option' instead of 'IEOption':

>> d = IQML('lookup','datatype','symbols','name','GOOG','SecTypes',{'Equity','Option'})

Invalid SecType(s) "OPTION". Allowed values: ARGUS, ARGUSFC, BONDS, CALC,

COMBINED_FOPTION, COMBINED_FUTURE, COMM3, EQUITY, FAST_RACKS, FOPTION, FOPTION_IV, FOREX, FORWARD, FUTURE, ICSPREAD, IEOPTION, INDEX, ISO, JACOBSEN, MKTRPT, MKTSTATS, MONEY, MUTUAL, NP_CAPACITY, NP_FLOW, NP_POWER, PETROCHEMWIRE, PRECMTL, RACKS, RFSPOT, SNL_ELEC, SNL_NG, SPOT, SPREAD, STRATSPREAD, STRIP, SWAPS, TREASURIES

When you specify Market(s) names (as opposed to IDs), note that IQML will match the specified names as broadly as possible, with any exchange whose name or description contain the specified values.144 For example, 'NASDAQ' will match not only symbols that list directly on NASDAQ, but also symbols on Nasdaq Global Market (NGM), Nasdaq Global Select Market (NGSM), Nasdaq OMX Futures (NFX), Nasdaq other OTC, Nasdaq OTC Bulletin Board (OTCBB), etc. To receive only symbols that list directly on NASDAQ (but not its affiliate markets), specify the market ID (NASDAQ=5), instead of its name. See §8.3 for valid market ID values.

Instead of Market name(s) or SecType name(s), you can specify their corresponding numeric codes,145 as a scalar integer value or as a numeric array of integers:

>> data = IQML('lookup','datatype','symbols','name','GOOG','SecTypes',1);

>> data = IQML('lookup','datatype','symbols','name','GOOG','SecTypes',[1,2]);

>> data = IQML('lookup','datatype','symbols','name','GOOG','Markets',21);

>> data = IQML('lookup','datatype','symbols','name','GOOG',’Markets',[21,14]);

In addition IQML’s symbols lookup functionality, users can search DTN’s database online, at https://ws1.dtn.com/IQ/Search. A guide to the symbology used for various security types by different exchanges is available at https://ws1.dtn.com/IQ/Guide.

Here is a summary of the IQML parameters that affect symbols lookup:

Parameter | Data type | Default | Description |

Name | string | '' | Limits the query to assets that contain the specified string in their symbol name (case insensitive, anywhere within the symbol name) |

Description | string | '' | Limits the query to assets that contain the specified string in their description (case insensitive, anywhere within the description) |

Market or Markets 146 | integer, numeric array, string, or cell-array of strings | [] (empty) | Limits the query to assets that belong to the specified market code(s) (scalar integer or numeric array), or market name(s) (case-insensitive string or cell-array of strings). See §8.3 for details on valid values. |

SecType or SecTypes 147 | integer, numeric array, string, or cell-array of strings | [] (empty) | Limits the query to assets that have the specified security type code(s) (scalar integer or numeric array), or security type name(s) (case-insensitive string or cell-array of strings). See §8.4 for details on valid values. |

SIC | integer | [] (empty) | Limits the query to assets that belong to the specified SIC sector/industry See §8.5 for details on valid values. |

NAICS | integer | [] (empty) | Limits the query to assets that belong to the specified NAICS sector/industry See §8.6 for details on valid values. |

Timeout | number | 5.0 | Max # of seconds to wait for incoming data |

Progress | string | '' | When Progress is set to 'console', the data download progress is displayed in the console |

8.2 Options/futures chain

To retrieve a list of symbols that belong to a certain options/futures chain and match certain criteria, set the action to 'chain'; DataType to one of 'options' (default), 'futures', 'foptions' (future options), or 'spreads'; Symbol to the underlying contract’s symbol; and then add optional filtering criteria. For example:148

>> symbols = IQML('chain', 'Symbol','GOOG')' % options chain for GOOG

symbols =

1×1454 cell array

Columns 1 through 4

'GOOG1803H1000' 'GOOG1803H1010' 'GOOG1803H1020' 'GOOG1803H1030'

Columns 5 through 8

'GOOG1803H1040' 'GOOG1803H1050' 'GOOG1803H1055' 'GOOG1803H1060'

Columns 9 through 12

'GOOG1803H1065' 'GOOG1803H1070' 'GOOG1803H1075' 'GOOG1803H1077.5'

...

Depending on DataType, several filtering parameters can be specified: All chain queries support the Symbol, Months, and NearMonths parameters. Options-related queries (DataType='options' or 'foptions') also support a Side parameter. Index/equity options query (DataType='options') also supports IncludeBinary, MinStrike, MaxStrike, NumInMoney, NumOutOfMoney parameters. All chain queries except 'options' also support the Years parameter. Here’s an example filtered chain query:

% Report GOOG options having strike price between $1000-$1010 in next 4 months

>> symbols = IQML('chain', 'symbol','GOOG', 'NearMonths',4, ...

'MinStrike',1000, 'MaxStrike',1010)'

symbols =

1×58 cell array

Columns 1 through 4

'GOOG1803H1000' 'GOOG1803H1010' 'GOOG1810H1000' 'GOOG1810H1005'

Columns 5 through 8

'GOOG1810H1010' 'GOOG1813G1000' 'GOOG1813G1002.5' 'GOOG1813G1005'

Columns 9 through 12

'GOOG1813G1007.5' 'GOOG1813G1010' 'GOOG1817H1000' 'GOOG1817H1005'

...

The following table lists the valid combinations of filtering parameters per DataType:

↓parameter \ DataType: → | options | future | spread | foption |

Symbol | ok | ok | ok | ok |

Side | ok | N/A | N/A | ok |

Months | ok | ok | ok | ok |

NearMonths | ok | ok | ok | ok |

Years | N/A | ok | ok | ok |

IncludeBinary | ok | N/A | N/A | N/A |

MinStrike | ok | N/A | N/A | N/A |

MaxStrike | ok | N/A | N/A | N/A |

NumInMoney | ok | N/A | N/A | N/A |

NumOutOfMoney | ok | N/A | N/A | N/A |

Note that if you filter by MinStrike and/or MaxStrike, you cannot also filter by NumInMoney/ NumOutOfMoney (and vice versa):

>> IQML('chain', 'symbol','IBM','NumInMoney',2,'NumOutOfMoney',2,'MinStrike',90)

You cannot specify both a strike range and number of contracts in/out of money in 'chain' query - choose only one set

Similarly, you can only specify one of the Months, NearMonths parameters, not both:

>> IQML('chain', 'symbol','IBM', 'Months',2:6, 'NearMonths',3)

Either the Months or the NearMonths parameter can be specified, but not both, in a 'chain' query

If no symbols match the specified criteria, or if you do not have the necessary market permissions (subscription), then the IQML query will return an empty cell array:

>> symbols = IQML('chain', 'datatype','spreads','symbol','C','years',2010:2019)

symbols =

0×0 empty cell array

![]() Note: IQFeed only returns active (non-expired) contracts. IQFeed offers downloadable static text files, which contain a [very long] list of securities that are no longer traded (expired contacts149 and delisted equities150). These files are not actively maintained by DTN IQFeed, so it is better to use the API functionality via IQML. With IQFeed client 6.1 or newer, you can also fetch this data using IQML (see §5.6).

Note: IQFeed only returns active (non-expired) contracts. IQFeed offers downloadable static text files, which contain a [very long] list of securities that are no longer traded (expired contacts149 and delisted equities150). These files are not actively maintained by DTN IQFeed, so it is better to use the API functionality via IQML. With IQFeed client 6.1 or newer, you can also fetch this data using IQML (see §5.6).

If you set WhatToShow to 'quotes', you’ll receive an array of structs that contain the corresponding latest (top-of-market) quotes data for the corresponding symbols:

>> data = IQML('chain', 'symbol','GOOG', 'NearMonths',4, ...

'MinStrike',1000, 'MaxStrike',1010, 'WhatToShow','quotes')

data =

58×1 struct array with fields:

Symbol

...

>> data(1)

ans =

struct with fields:

Symbol: 'GOOG1803H1000'

Most_Recent_Trade: 120

Most_Recent_Trade_Size: 1

Most_Recent_Trade_Time: '15:57:12.930497'

Total_Volume: 0

Bid: 140.5

Bid_Size: 3

...

Close: 120

Message_Contents: 'Cbacv'

Message_Description: ...

Most_Recent_Trade_Conditions: 1

Trade_Conditions_Description: 'Normal Trade'

Most_Recent_Market_Name: 'MIAX PEARL Options exchange'

>> symbols = {data.Symbol}

symbols =

1×58 cell array

Columns 1 through 4

'GOOG1803H1000' 'GOOG1803H1010' 'GOOG1810H1000' 'GOOG1810H1005'

Columns 5 through 8

'GOOG1810H1010' 'GOOG1813G1000' 'GOOG1813G1002.5' 'GOOG1813G1005'

...

Note: to receive quotes data for chain options, you must have a corresponding DTN data subscription, otherwise IQFeed (and IQML) will report an error for all contracts:

IQFeed error: Symbol 'GOOG2221A3000' is invalid/unavailable!

IQFeed error: Symbol 'GOOG2228A3000' is invalid/unavailable!

IQFeed error: Symbol 'GOOG2131X3000' is invalid/unavailable!

IQFeed error: Symbol 'GOOG2207M3000' is invalid/unavailable!

...

Note: if you request quotes for multiple chain symbols, especially if you set UseParallel to true, you might reach your IQFeed account’s symbols-limit (MaxSymbols; see §9.3). In such cases, IQFeed-generated error messages will be displayed on the Matlab console:

Level1 symbol limit reached - symbol 'GOOG2019R600' not serviced!

You can request IQFeed to report a user-specified set of quotes data fields and/or change the reported fields order, using the optional Fields parameter (see §4.1). If you don’t specify Fields, the returned data is subject to the Fields parameter that was set in the most recent quotes or chain query.

Also note that some of these structs (especially for out-of-money contracts) may contain empty/invalid data, since their corresponding contract was never traded. For example:

>> data(7)

ans =

struct with fields:

Symbol: 'GOOG1813G1002.5'

Most_Recent_Trade: []

Most_Recent_Trade_Size: []

Most_Recent_Trade_Time: []

Most_Recent_Trade_Market_Center: []

Total_Volume: 0

Bid: 133.4

Bid_Size: 2

Ask: 140.2

Ask_Size: 1

Open: []

High: []

Low: []

Close: []

Message_Contents: 'bav'

Message_Description: 'A bid update occurred; An ask update occurred; A volume update occurred'

Most_Recent_Trade_Conditions: 1

Trade_Conditions_Description: 'Normal Trade'

Most_Recent_Market_Name: ''

For this reason, you should be careful when concatenating the struct array’s data into numeric arrays. In this example, only 40 of the 58 contracts had a Close price, so concatenating into a numeric array results in an array that only has 40 data items:

>> [data.Close]

ans =

Columns 1 through 8

120 130.7 140.67 131.99 150.1 138.8 139.5 99.47

Columns 9 through 16

103.28 130.9 179.5 137.5 190.17 89.3 145 3.84

Columns 17 through 24

6 7.5 5.3 7.14 0.3 0.3 1.1 1.32

Columns 25 through 32

1.05 5.56 9.9 6.35 0.67 0.75 1.23 10

Columns 33 through 40

15.43 16.33 27.21 32.3 33.4 6.49 2.5 3.37

…instead, it is better in most cases to use cell arrays, where we can see empty cells:

>> {data.Close}

ans =

1×58 cell array

Columns 1 through 8

[120] [] [130.7] [] [] [140.67] [] []

Columns 9 through 16

[] [] [131.99] [150.1] [138.8] [139.5] [] [99.47]

Columns 17 through 24

[] [103.28] [130.9] [179.5] [137.5] [190.17] [] [89.3]

Columns 25 through 33

...

Similarly, set WhatToShow='fundamental' to get the fundamental data for all symbols in the requested chain. For example:

>> data = IQML('chain', 'symbol','GOOG', 'NearMonths',4, ...

'MinStrike',1000, 'MaxStrike',1010, ...

'WhatToShow','fundamental')

data =

58×1 struct array with fields:

Symbol

Exchange_ID

PE

Average_Volume

...

>> data(1)

ans =

struct with fields:

Symbol: 'GOOG1803H1000'

Exchange_ID: 'E'

PE: []

Average_Volume: []

x52_Week_High: 120

x52_Week_Low: 120

Calendar_Year_High: []

Calendar_Year_Low: []

...

Fiscal_Year_End: []

Company_Name: 'GOOG AUG 2018 C 1000.00'

...

Expiration_Date: '08/03/2018'

Strike_Price: 1000

NAICS: []

Exchange_Root: []

Option_Premium_Multiplier: 100

Option_Multiple_Deliverable: 0

Price_Format_Description: 'Two decimal places'

Exchange_Description: 'Euronext Index Derivatives (ENID)'

Listed_Market_Description: 'OPRA System'

Security_Type_Description: 'Index/Equity Option'

SIC_Description: ''

NAICS_Description: ''

>> [data.Strike_Price]

ans =

Columns 1 through 8

1000 1010 1000 1005 1010 1000 1002.5 1005

Columns 9 through 16

1007.5 1010 1000 1005 1010 1000 1002.5 1005

Columns 17 through 24

1007.5 1010 1000 1005 1010 1000 1005 1010

...

![]() Note: using WhatToShow iterates over all the reported chain symbols, requesting the quotes/fundamental data for each symbol separately. If the number of symbols is large, this could take a very long time, even if you parallelize the queries using UseParallel.

Note: using WhatToShow iterates over all the reported chain symbols, requesting the quotes/fundamental data for each symbol separately. If the number of symbols is large, this could take a very long time, even if you parallelize the queries using UseParallel.

As an alternative in such cases, consider using a market summary query for the exchange on which the chain’s contracts are traded (see §4.6). Once you get the summary report, you can then extract the relevant market data for the contracts that were reported by the chain command.151 A summary report may take several minutes to download since it reports all the contracts of a certain type on that exchange, but this could still be faster than the symbols iteration used by a chain query with WhatToShow.

The decision whether to use the chain query with WhatToShow, or a combination of a simple chain query and market summary query, depends on the number of chain contracts and other factors. Advice: try a unified chain query first, and use the market summary alternative only in case the unified chain query takes too long.

Here is a summary of the IQML parameters that affect chain symbols lookup:

Parameter | Data type | Default | Description |

Symbol | string | '' must be set! | Symbol name of the underlying contract. This is a mandatory parameter – it must be set. |

DataType | string | 'options' | One of: 'options' (default) – on index/equity 'future' 'spread' – future calendar spreads 'foptions' – options on future |

Side | string | 'cp' (meaning both calls and puts) | One of: 'cp' (default) – both calls and puts 'c' – calls only 'p' – puts only Only relevant if DataType='options'/'foptions' |

WhatToShow | string | 'symbols' | One of: 'symbols' (default) – list of symbols in chain 'quotes' – return the latest quotes data 'fundamental' – return fundamental data |

Months | various | [] meaning all | One of: Numeric month value(s) between 1-12 (e.g.: 4, 2:5, [1,4,7]) English month name (e.g. 'August', 'Apr') English month names in cell array (e.g. {'Apr', 'July', 'September', 'Dec'}) Financial month codes from the list FGHJKMNQUVXZ (e.g. 'JKMN') Cannot be specified together with NearMonths |

NearMonths | integer (0-99) | [] | Number of nearby contract months to report.152 Cannot be specified together with Months. |

Years | integer scalar/array | [] meaning current year | 1+ years e.g. 2013:2019, default: current year. Only relevant when DataType ≠ 'options'. |

IncludeBinary | logical | false or 0 | If true, binary/weekly options153 are reported, otherwise (default) they are not. This parameter is only relevant when DataType='options'. |

MinStrike | number | [] | Only report options having a higher strike price; only relevant when DataType='options'. |

MaxStrike | number | [] | Only report options having a lower strike price; only relevant when DataType='options'. |

NumInMoney | integer | [] | Only report this number of options in the money; only relevant if DataType='options'. |

NumOutOf | integer | [] | Only report this number of options out of money; only relevant if DataType='options'. |

UseParallel | logical (true/false) | false | If set to true or 1, then querying chain quotes will be done in parallel if possible (see §3.6). |

MaxWorkers | integer | (the current pool size) | Max number of parallel workers to use (up to the current pool size) when UseParallel=1 |

Fields | colon or comma-separated string, or cell-array of strings | 'Symbol, Most Recent Trade, Most Recent Trade Size, Most Recent Trade Time, Most Recent Trade Market Center, Total Volume, Bid, Bid Size, Ask, Ask Size, Open, High, Low, Close, Message Contents, Most Recent Trade Conditions' | Sets the list of data fields reported by IQFeed for each quote. IQFeed’s default set has 16 fields; 50+ additional fields can be specified (a detailed list of fields is provided in §4.1). If Fields is set to an empty value ({} or ''), the list of current, available fields is returned. If Fields is not empty, subsequent quotes and chain queries will return the specified fields, in the specified order. The Symbol field is always returned first, even if not specified. Examples: 'Bid:Ask:Last:Ask Size' 'Bid, Ask, Last, Ask Size' {'Bid', 'Ask', 'Last', 'Ask Size'} 'All' (indicates all available fields) |

![]() Note: Options/futures chain lookup is only available in the Professional IQML license.

Note: Options/futures chain lookup is only available in the Professional IQML license.

8.3 Markets lookup

To retrieve a list of markets (exchanges), use 'lookup' action with 'markets' DataType:

>> data = IQML('lookup', 'DataType','markets')

data =

185×1 struct array with fields:

id

name

description

groupId

groupName

>> data(1)

ans =

id: 1

name: 'NGM'

description: 'Nasdaq Global Market'

groupId: 5

groupName: 'NASDAQ'

...

You can convert the data into a [perhaps] more readable form using Matlab’s builtin struct2cell() and struct2table() functions, or the OutputFormat parameter (§3.5):

>> struct2cell(data)'

ans =

185×5 cell array

[1] 'NGM' 'Nasdaq Global Market' [5] 'NASDAQ'

[2] 'NCM' 'National Capital Market' [5] 'NASDAQ'

[3] 'OTC' 'Nasdaq other OTC' [5] 'NASDAQ'

[4] 'OTCBB' 'Nasdaq OTC Bulletin Board' [5] 'NASDAQ'

[5] 'NASDAQ' 'Nasdaq' [5] 'NASDAQ'

[6] 'NYSE_AMERICAN' 'NYSE American (Equities and Bonds)' [6] 'NYSE_AMERICAN'

[7] 'NYSE' 'New York Stock Exchange' [7] 'NYSE'

...

>> struct2table(data)

ans =

185×5 table

id name description groupId groupName

__ _______________ ____________________________________ _______ _____________

1 'NGM' 'Nasdaq Global Market' 5 'NASDAQ'

2 'NCM' 'National Capital Market' 5 'NASDAQ'

3 'OTC' 'Nasdaq other OTC' 5 'NASDAQ'

4 'OTCBB' 'Nasdaq OTC Bulletin Board' 5 'NASDAQ'

5 'NASDAQ' 'Nasdaq' 5 'NASDAQ'

6 'NYSE_AMERICAN' 'NYSE American (Equities and Bonds)' 6 'NYSE_AMERICAN'

7 'NYSE' 'New York Stock Exchange' 7 'NYSE'

You can narrow-down the results by specifying ID, Name and/or Description filtering parameters. For example, to list only markets whose Description contains ‘Nasdaq’:

>> data = IQML('lookup', 'DataType','markets', 'Description','Nasdaq')

data =

10×1 struct array with fields:

id

name

description

groupId

groupName

>> disp(struct2cell(data)')

[ 1] 'NGM' 'Nasdaq Global Market' [ 5] 'NASDAQ'

[ 3] 'OTC' 'Nasdaq other OTC' [ 5] 'NASDAQ'

[ 4] 'OTCBB' 'Nasdaq OTC Bulletin Board' [ 5] 'NASDAQ'

[ 5] 'NASDAQ' 'Nasdaq' [ 5] 'NASDAQ'

[ 15] 'NASD_ADF' 'Nasdaq Alternate Display facility' [ 5] 'NASDAQ'

[ 19] 'NTRF' 'Nasdaq Trade Reporting Facility' [ 5] 'NASDAQ'

[ 21] 'NGSM' 'Nasdaq Global Select Market' [ 5] 'NASDAQ'

[105] 'PK_NASDAQ' 'Pink Sheets - NASDAQ Listed' [ 90] 'PK_SHEETS'

[134] 'N2EX' 'NASDAQ OMX-Nord Pool' [134] 'N2EX'

[139] 'NFX' 'NASDAQ OMX Futures' [139] 'NFX'

Naturally, it is quite possible that no markets exist that match the requested criteria. In such a case, the result will be empty (and cannot be displayed using Matlab’s struct2table() or struct2cell() functions):

>> data = IQML('lookup', 'DataType','markets', 'Name','xyz')

data =

[]

>> struct2cell(data)

Undefined function 'struct2cell' for input arguments of type 'double'.

For performance reasons, and since lookup data is fairly static (although it changes from time to time), it is usually fetched from the IQFeed servers only during IQML startup. All subsequent lookup queries will return pre-fetched (cached) data, filtered as needed based on your query criteria. To force IQML to fetch the latest lookup data from IQFeed instead of the cached data, set the ForceRefresh parameter to true (or 1).

Note: IQFeed does not currently offer additional information about the listed markets, such as their time-zone, operating times, and duration for delayed quotes.154 A table of time-zones and delay amounts (but not operating times) for markets in DTN’s ProphetX service is posted on http://pxweb.dtn.com/PXWebDoc/pages/Markets.aspx. These markets generally overlap IQFeed’s markets, but the market names are somewhat different (for example, Singapore’s International Monetary Exchange is named 'SIME' in ProphetX, vs. 'SGX' in IQFeed). It is unclear to what extent ProphetX’s market information is up-to-date or relevant to IQFeed, so be careful when using it.

Here is a summary of the IQML parameters that affect markets lookup:

Parameter | Data type | Default | Description |

ID | integer or numeric array | [] (empty) | Limits the query to the specified ID(s). |

Name | string | '' | Limits the query to markets that contain the specified string in their name or groupName (case insensitive, anywhere within the name) |

Description | string | '' | Limits the query to markets that contain the specified string in their description (case insensitive, anywhere within the description) |

ForceRefresh | logical (true/false) | false | If set to true or 1, then the data will be fetched from the IQFeed servers, not pre-cached data. |

8.4 Security types lookup

To retrieve a list of security types, set action to 'lookup' and DataType to 'sectypes':

>> data = IQML('lookup', 'DataType','sectypes')

data =

40×1 struct array with fields:

id

name

>> data(1)

ans =

id: 1

name: 'EQUITY'

description: 'Equity'

>> data(2)

ans =

id: 2

name: 'IEOPTION'

description: 'Index/Equity Option'

You can convert the data into a [perhaps] more readable form using Matlab’s builtin struct2cell() and struct2table() functions, or the OutputFormat parameter (§3.5):

>> disp(struct2cell(data)')

[ 1] 'EQUITY' 'Equity'

[ 2] 'IEOPTION' 'Index/Equity Option'

[ 3] 'MUTUAL' 'Mutual Fund'

[ 4] 'MONEY' 'Money Market Fund'

[ 5] 'BONDS' 'Bond'

[ 6] 'INDEX' 'Index'

[ 7] 'MKTSTATS' 'Market Statistic'

[ 8] 'FUTURE' 'Future'

[ 9] 'FOPTION' 'Future Option'

[10] 'SPREAD' 'Future Spread'

[11] 'SPOT' 'Spot'

[12] 'FORWARD' 'Forward'

...

>> disp(struct2table(data))

id name description

__ __________________ ______________________________________________

1 'EQUITY' 'Equity'

2 'IEOPTION' 'Index/Equity Option'

3 'MUTUAL' 'Mutual Fund'

4 'MONEY' 'Money Market Fund'

5 'BONDS' 'Bond'

6 'INDEX' 'Index'

...

>> data = IQML('lookup', 'DataType','sectypes', 'OutputFormat','table')

data =

40×3 table

id name description

__ __________________ ______________________________________________

1 'EQUITY' 'Equity'

2 'IEOPTION' 'Index/Equity Option'

3 'MUTUAL' 'Mutual Fund'

4 'MONEY' 'Money Market Fund'

5 'BONDS' 'Bond'

6 'INDEX' 'Index'

...

You can narrow-down the results by specifying ID, Name and/or Description filtering parameters. For example, to list only secTypes whose Description contains ‘Option’:

>> struct2table(IQML('lookup', 'DataType','sectypes', 'Description','option'))

ans =

4×3 table

id name description

__ __________________ ____________________________

2 'IEOPTION' 'Index/Equity Option'

9 'FOPTION' 'Future Option'

36 'COMBINED_FOPTION' 'Combined FOption Volume OI'

39 'FOPTION_IV' 'FOption Implied Volatility'

Naturally, it is quite possible that no security types exist that match the requested criteria. In such a case, the result will be empty (and cannot be displayed using Matlab’s struct2table() or struct2cell() functions):

>> data = IQML('lookup', 'DataType','sectypes', 'Name','xyz')

data =

[]

>> struct2cell(data)

Undefined function 'struct2cell' for input arguments of type 'double'.

For performance reasons, and since lookup data is fairly static (although it changes from time to time), it is usually fetched from the IQFeed servers only during IQML startup. All subsequent lookup queries will return pre-fetched (cached) data, filtered as needed based on your query criteria. To force IQML to fetch the latest lookup data from IQFeed instead of the cached data, set the ForceRefresh parameter to true (or 1).

Here is a summary of the IQML parameters that affect security types lookup:

Parameter | Data type | Default | Description |

ID | integer or numeric array | [] (empty) | Limits the query to the specified ID(s). |

Name | string | '' | Limits the query to secTypes that contain the specified string in their name |

Description | string | '' | Limits the query to secTypes that contain the specified string in their description (case insensitive, anywhere within the description) |

ForceRefresh | logical (true/false) | false | If set to true or 1, then the data will be fetched from the IQFeed servers, not pre-cached data. |

8.5 SIC codes lookup

To retrieve a list of SIC sectors/industries, set action to 'lookup' and DataType to 'SIC':

>> data = IQML('lookup', 'DataType','SIC')

data =

1005×1 struct array with fields:

id

description

>> data(1)

ans =

id: 111

description: 'WHEAT'

>> data(2)

ans =

id: 112

description: 'RICE'

You can convert the data into a [perhaps] more readable form using Matlab’s builtin struct2cell() and struct2table() functions, or the OutputFormat parameter (§3.5):

>> disp(struct2cell(data)')

[111] 'WHEAT'

[112] 'RICE'

[115] 'CORN'

[116] 'SOYBEANS'

[119] 'CASH GRAINS, NOT ELSEWHERE CLASSIFIED'

[131] 'COTTON'

[132] 'TOBACCO'

...

>> disp(struct2table(data))

id description

___ ___________________________________________________________

111 'WHEAT'

112 'RICE'

115 'CORN'

116 'SOYBEANS'

119 'CASH GRAINS, NOT ELSEWHERE CLASSIFIED'

131 'COTTON'

132 'TOBACCO'

...

>> data = IQML('lookup', 'DataType','SIC', 'OutputFormat','table')

data =

1005×2 table

id description

___ ___________________________________________________________

111 'WHEAT'

112 'RICE'

115 'CORN'

116 'SOYBEANS'

119 'CASH GRAINS, NOT ELSEWHERE CLASSIFIED'

131 'COTTON'

132 'TOBACCO'

...

You can narrow-down the results by specifying ID or Description filtering parameters. For example, to list only the SIC codes whose Description contains ‘Oil’:

>> struct2table(IQML('lookup', 'DataType','SIC', 'Description','oil'))

ans =

22×2 table

id description

____ ___________________________________________________________________

251 'BROILER, FRYER, AND ROASTER CHICKENS'

711 'SOIL PREPARATION SERVICES'

1381 'DRILLING OIL AND GAS WELLS'

1382 'OIL AND GAS FIELD EXPLORATION SERVICES'

1389 'OIL AND GAS FIELD SERVICES, NOT ELSEWHERE CLASSIFIED'

2074 'COTTONSEED OIL MILLS'

2075 'SOYBEAN OIL MILLS'

2076 'VEGETABLE OIL MILLS, EXCEPT CORN, COTTONSEED, AND SOYBEAN'

2077 'ANIMAL AND MARINE FATS AND OILS'

2079 'SHORTENING, TABLE OILS, MARGARINE, AND OTHER EDIBLE FATS AND OILS'

2673 'PLASTICS, FOIL, AND COATED PAPER BAGS'

...

Naturally, it is quite possible that no security types exist that match the requested criteria. In such a case, the result will be empty (and cannot be displayed using Matlab’s struct2table() or struct2cell() functions):

>> data = IQML('lookup', 'DataType','SIC', 'Description','xyz')

data =

[]

>> struct2cell(data)

Undefined function 'struct2cell' for input arguments of type 'double'.

For performance reasons, and since lookup data is fairly static (although it changes from time to time), it is usually fetched from the IQFeed servers only during IQML startup. All subsequent lookup queries will return pre-fetched (cached) data, filtered as needed based on your query criteria. To force IQML to fetch the latest lookup data from IQFeed instead of the cached data, set the ForceRefresh parameter to true (or 1).

![]() Note: IQFeed has a confirmed internal bug as of October 2019: some ~150 SIC codes are not reported, although they have corresponding symbols and are reported by the symbols lookup query (§8.1).155 Symbols having such SIC codes will have an empty SIC_Description field in the fundamental data query (§4.2) and empty SIC_Desc field in the symbols lookup query (§8.1).

Note: IQFeed has a confirmed internal bug as of October 2019: some ~150 SIC codes are not reported, although they have corresponding symbols and are reported by the symbols lookup query (§8.1).155 Symbols having such SIC codes will have an empty SIC_Description field in the fundamental data query (§4.2) and empty SIC_Desc field in the symbols lookup query (§8.1).

Here is a summary of the IQML parameters that affect SIC codes lookup:

Parameter | Data type | Default | Description |

ID | integer or numeric array | [] (empty) | Limits the query to the specified ID(s). |

Description | string | '' | Limits the query to SIC entries that contain the specified string in their description (case insensitive, anywhere within the description) |

ForceRefresh | logical (true/false) | false | If set to true or 1, then the data will be fetched from the IQFeed servers, not pre-cached data. |

8.6 NAICS codes lookup

To retrieve a list of NAICS sectors/industries, set the action to 'lookup' and DataType to 'NAICS':

>> data = IQML('lookup', 'DataType','NAICS')

data =

1175×1 struct array with fields:

id

description

>> data(1)

ans =

id: 111110

description: 'Soybean Farming'

>> data(2)

ans =

id: 111120

description: 'Oilseed (except Soybean) Farming'

You can convert the data into a [perhaps] more readable form using Matlab’s builtin struct2cell() and struct2table() functions, or the OutputFormat parameter (§3.5):

>> disp(struct2cell(data)')

[111110] 'Soybean Farming'

[111120] 'Oilseed (except Soybean) Farming'

[111130] 'Dry Pea and Bean Farming'

[111140] 'Wheat Farming'

[111150] 'Corn Farming'

[111160] 'Rice Farming'

[111191] 'Oilseed and Grain Combination Farming'

[111199] 'All Other Grain Farming'

[111211] 'Potato Farming'

...

>> disp(struct2table(data))

id description

______ ___________________________________________________

111110 'Soybean Farming'

111120 'Oilseed (except Soybean) Farming'

111130 'Dry Pea and Bean Farming'

111140 'Wheat Farming'

111150 'Corn Farming'

111160 'Rice Farming'

111191 'Oilseed and Grain Combination Farming'

111199 'All Other Grain Farming'

111211 'Potato Farming'

...

>> data = IQML('lookup', 'DataType','NAICS', 'OutputFormat','table')

data =

1175×2 table

id description

___ ___________________________________________________________

111110 'Soybean Farming'

111120 'Oilseed (except Soybean) Farming'

111130 'Dry Pea and Bean Farming'

111140 'Wheat Farming'

111150 'Corn Farming'

111160 'Rice Farming'

111191 'Oilseed and Grain Combination Farming'

111199 'All Other Grain Farming'

111211 'Potato Farming'

...

You can narrow-down the results by specifying the ID or Description filtering parameter. For example, to list only NAICS codes whose Description contains ‘Oil’:

>> struct2table(IQML('lookup', 'DataType','NAICS', 'Description','oil'))

ans =

20×2 table

id description

______ ____________________________________________________________________

111120 'Oilseed (except Soybean) Farming'

111191 'Oilseed and Grain Combination Farming'

112320 'Broilers and Other Meat Type Chicken Production'

115112 'Soil Preparation, Planting, and Cultivating'

213111 'Drilling Oil and Gas Wells'

213112 'Support Activities for Oil and Gas Operations'

237120 'Oil and Gas Pipeline and Related Structures Construction'

311223 'Other Oilseed Processing'

311225 'Fats and Oils Refining and Blending'

...

Naturally, it is quite possible that no security types exist that match the requested criteria. In such a case, the result will be empty (and cannot be displayed using Matlab’s struct2table() or struct2cell() functions):

>> data = IQML('lookup', 'DataType','NAICS', 'Description','xyz')

data =

[]

>> struct2cell(data)

Undefined function 'struct2cell' for input arguments of type 'double'.

For performance reasons, and since lookup data is fairly static (although it changes from time to time), it is usually fetched from the IQFeed servers only during IQML startup. All subsequent lookup queries will return pre-fetched (cached) data, filtered as needed based on your query criteria. To force IQML to fetch the latest lookup data from IQFeed instead of the cached data, set the ForceRefresh parameter to true (or 1).

![]() Note: IQFeed has a confirmed internal bug as of October 2019: some ~150 SIC codes are not reported, although they have corresponding symbols and are reported by the symbols lookup query (§8.1).156 A similar bug also applies to NAICS.

Note: IQFeed has a confirmed internal bug as of October 2019: some ~150 SIC codes are not reported, although they have corresponding symbols and are reported by the symbols lookup query (§8.1).156 A similar bug also applies to NAICS.

Here is a summary of the IQML parameters that affect NAICS codes lookup:

Parameter | Data type | Default | Description |

ID | integer or numeric array | [] (empty) | Limits the query to the specified ID(s). |

Description | string | '' | Limits the query to NAICS entries that contain the specified string in their description (case insensitive, anywhere within the description) |

ForceRefresh | logical (true/false) | false | If set to true or 1, then the data will be fetched from the IQFeed servers, not pre-cached data. |

8.7 Trade condition codes lookup

To retrieve a list of trade condition codes, set the action to 'lookup' and DataType to 'conditions':

>> data = IQML('lookup', 'DataType','conditions')

data =

155×1 struct array with fields:

id

name

description

>> data(1)

ans =

id: 1

name: 'REGULAR'

description: 'Normal Trade'

>> data(2)

ans =

id: 2

name: 'ACQ'

description: 'Acquisition'

You can convert the data into a [perhaps] more readable form using Matlab’s builtin struct2cell() and struct2table() functions, or the OutputFormat parameter (§3.5):

>> disp(struct2cell(data)')

[ 1] 'REGULAR' 'Normal Trade'

[ 2] 'ACQ' 'Acquisition'

[ 3] 'CASHM' 'Cash Only Market'

[ 4] 'BUNCHED' 'Bunched Trade'

[ 5] 'AVGPRI' 'Average Price Trade'

[ 6] 'CASH' 'Cash Trade (same day clearing)'

...

>> disp(struct2table(data))

id name description

__ _____________ ________________________________

1 'REGULAR' 'Normal Trade'

2 'ACQ' 'Acquisition'

3 'CASHM' 'Cash Only Market'

4 'BUNCHED' 'Bunched Trade'

5 'AVGPRI' 'Average Price Trade'

6 'CASH' 'Cash Trade (same day clearing)'

...

>> data = IQML('lookup', 'DataType','conditions', 'OutputFormat','table')

data =

155×3 table

id name description

__ _____________ ________________________________

1 'REGULAR' 'Normal Trade'

2 'ACQ' 'Acquisition'

3 'CASHM' 'Cash Only Market'

4 'BUNCHED' 'Bunched Trade'

5 'AVGPRI' 'Average Price Trade'

6 'CASH' 'Cash Trade (same day clearing)'

...

You can narrow-down the results by specifying ID, Name and/or Description filtering parameters. For example, to list only conditions whose Description contains ‘Option’:

>> struct2table(IQML('lookup', 'DataType','conditions', 'Description','option'))

ans =

7×3 table

id name description

__ ______________ ___________________________________________________

39 'SPRD' 'Spread - Trade in Two Options in the Same Class

(a buy and a sell in the same class)'

40 'STDL' 'Straddle - Trade in Two Options in the Same Class

(a buy and a sell in a put and a call)'

43 'BWRT' 'Option Portion of a Buy/Write'

44 'CMBO' 'Combo - Trade in Two Options in the Same Options

Class (a buy and a sell in the same class)'

68 'STKOPT_TRADE' 'Stock-Option Trade'

82 'OPTION_EX' 'Option Exercise'

96 'OPT_ADDON' 'Short Option Add-On'

Naturally, it is quite possible that no security types exist that match the requested criteria. In such a case, the result will be empty (and cannot be displayed using Matlab’s struct2table() or struct2cell() functions):

>> data = IQML('lookup', 'DataType','conditions', 'Name','xyz')

data =

[]

>> struct2cell(data)

Undefined function 'struct2cell' for input arguments of type 'double'.

Note that the trade condition codes are typically reported by IQFeed as a string of one or more 2-digit hexadecimal values.157 For example (see §4.1):

>> data = IQML('quotes', 'Symbol','GOOG')

data =

...

Most_Recent_Trade_Conditions: '3D87'

Trade_Conditions_Description: 'Intramaket Sweep; Odd lot trade'

In this example, the reported last trade had 2 trade conditions: hexadecimal 3D (=61, meaning 'Intramaket Sweep')158 and hexadecimal 87 (=135, meaning 'Odd lot trade').

For performance reasons, and since lookup data is fairly static (although it changes from time to time), it is usually fetched from the IQFeed servers only during IQML startup. All subsequent lookup queries will return pre-fetched (cached) data, filtered as needed based on your query criteria. To force IQML to fetch the latest lookup data from IQFeed instead of the cached data, set the ForceRefresh parameter to true (or 1).

Here is a summary of the IQML parameters that affect trade conditions lookup:

Parameter | Data type | Default | Description |

ID | integer or numeric array | [] (empty) | Limits the query to the specified ID(s). |

Name | string | '' | Limits the query to trade conditions that contain the specified string in their name |

Description | string | '' | Limits the query to trade conditions that contain the specified string in their description (case insensitive, anywhere in the description) |

ForceRefresh | logical (true/false) | false | If set to true or 1, then the data will be fetched from the IQFeed servers, not pre-cached data. |

139 In this example, the matching SIC codes were 8331 (HQGE), 8351 (KVIL), 8361 (DRWN, NVOS, SPRV). IQFeed has a bug (as of October 2019): no data is returned if SIC or NAICS < 10 (http://forums.iqfeed.net/index.cfm?page=topic&topicID=5653).

140 The description of the various numeric codes for Market_ID, Sec_Type_ID, SIC and NAICS can be fetched separately – see §8.3-§8.6 for details

141 IQML can process ~1000 symbols per second; coupled with the network and server-processing latencies we can expect ~4000 symbols to accumulate before the default timeout of 5 seconds kicks in.

142 Note that you can use either Market or Markets as the parameter name, and similarly, either SecType or SecTypes.

143 IQFeed only returns the symbols of active (non-expired) options/futures. See §8.2 for details about expired contracts.

144 Technically speaking, IQML searches for the specified Market name case-insensitively in both the market names (acronyms) and in their description (see §8.3 for a list of available names/descriptions). For example:

'OTC' will match the following exchanges: OTC (Nasdaq Other OTC), OTCBB (Nasdaq OTC Bulletin Board), PK_IQXPREM (Pink Sheets – OTCQX – International PremierQX Tier), PK_QXPRIME (Pink Sheets – OTCQX – PrimeQX Tier), PK_BBONLY (Pink Sheets – OTCBB Only Tier) and several others.

'New' will match NYSE (New York Stock Exchange), NYMEX (New York Mercentile Exchange), NYISO (New York Independent System Operator), NEISO (New England Independent System Operator) and a few others.

'London' will match LSE (London Stock Exchange), LME (London Metals Exchange), LSEI (London Stock Exchange International), and LPPM (London Platinum and Palladium Market).

'amex' will match NYSE_AMEX (NYSE AMEX Options Exchange) and PK_NYSE_AMEX (Pink Sheets – NYSE AMEX Listed).

'commod' will match more than 20 exchanges, including COMEX (Commodities Exchange Center), ASXCM (ASX24 Commodities Exchange), ENCOM (EuroNext Commodities), KBCB (KCBOT-CBOT Intercommodity Spreads), DCE (Dalian Commodity Exchange), ZCE (Zengchou Commodity Exchange), and MCX (Multi Commodity Exchange of India).

145 See §8.3 and §8.4 for the list of numeric codes that correspond to each market and security type

146 In IQML, the Market and Markets parameters are synonymous – you can use either of them, in any capitalization

147 In IQML, the SecType and SecTypes parameters are synonymous – you can use either of them, in any capitalization

148 Option contract names in IQFeed use a variant of the OPRA OSI format. See a symbology guide at https://ws1.dtn.com/IQ/Guide, or an older version at https://iqfeed.net/symbolguide/index.cfm?symbolguide=guide. Also see the related discussion here: http://forums.dtn.com/index.cfm?page=topic&topicID=6968. Note: names might change due to corporate actions (splits etc.), for example: BBD1918A15 vs. BBD11918A15.45 (http://forums.iqfeed.net/index.cfm?page=topic&topicID=5495).

149 http://www.iqfeed.net/downloads/beta/IEOPTION.zip; see http://forums.iqfeed.net/index.cfm?page=topic&topicID=3326.

150 http://www.iqfeed.net/downloads/beta/EQUITY.zip; see http://forums.iqfeed.net/index.cfm?page=topic&topicID=5822.

152 IQFeed officially supports only 0-4, but in practice higher values are accepted, reporting contracts that expire farther out in the future (for example, 2.5 years for SPX). Note: this is undocumented IQFeed behavior, so specifying a value of 5 or higher may possibly not work properly (or at all) in certain cases. See http://forums.iqfeed.net/index.cfm?page=topic&topicID=5508

153 Weekly options are only excluded with IQFeed client 6.1 or newer; binary options are excluded with all clients.

157 Trade condition codes 15 or lower are reported with a leading 0, e.g. 05 or 0E. The availability of the codes’ translation in the Trade_Conditions_Description field depends on MsgParsingLevel=2 (which is the default value; see §3.2).

158 The missing “r” in “Intramarket” is a typo in IQFeed’s data