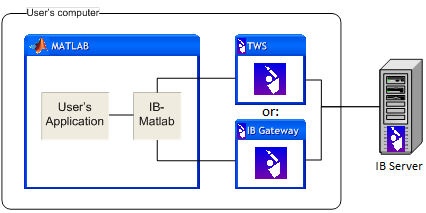

IBML (IB-Matlab): Matlab connector to InteractiveBrokers

IB-Matlab provides a reliable, easy-to-use Matlab interface to IB TWS or Gateway that works right out-of-the-box on all Matlab platforms (Win32, Win64, Mac, Linux):

- query current market data (quotes and market depth) in snapshot or streaming modes.

- fetch historical, intraday and live market data, using IB as a data-feed provider.

- lookup fundamental data, contract trading info and option chains on assets.

- place scanners that filter the market for securities that match certain criteria.

- retrieve the current portfolio contents, balance, P&L, margin, and other IB account values.

- place trade orders for multiple security types and trading parameters on dozens of exchanges worldwide.

- monitor open trade orders and track executions (partial/full).

- attach user-defined Matlab callback functions to ~40 data events sent by IB (trade executions, real-time tick data etc.)

IB-Matlab is optimized for excellent performance, reliability, stability, compatibility, feature set and overall value. Continuously maintained and improved since 2010, IB-Matlab is actively used by hundreds of financial institutions and individual traders/quants worldwide. A detailed User Guide is available, with multiple code usage examples and implementation tips.

A free trial is available.

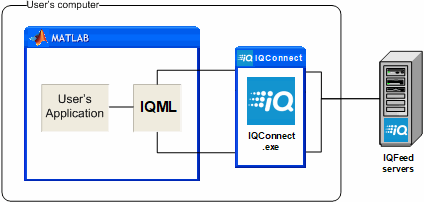

IQML: Matlab connector to DTN IQFeed

Simple Matlab commands access IQFeed’s data, in either blocking (snapshot) or non-blocking (streaming) mode:

- Live Level1 top-of-book market data (quotes and trades)

- Live Level2 market-depth data

- Historic, intra-day and live market data (individual ticks or interval bars)

- Fundamental info on assets

- Market scanner based on fundamental and trading criteria

- Options and futures chains lookup (with market data and Greeks)

- Symbols and market codes lookup

- News headlines, story-counts and complete news stories, with user-specified filters

- Ability to attach user-defined Matlab callback functions to IQFeed messages and market events

- User-defined custom alerts on streaming market events (news/quotes/interval-bar/regional triggers)

- Connection stats and programmatic connect/disconnect

IQML is optimized for excellent performance, reliability, stability, compatibility, feature set and overall value. Continuously maintained and improved since 2017, IQML is actively used by dozens of financial institutions and individual traders/quants worldwide. A detailed User Guide is available, with multiple code usage examples and implementation tips.

A free trial is available.

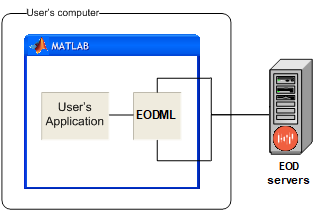

EODML: Matlab connector to EODHistoricalData

Simple Matlab commands can be used to access EOD’s data:

- Historic, intra-day and live (delayed) market data – OHLC bars, adjusted close and volume data

- Historic and upcoming splits, dividends, IPO, and earning events

- Historic basic technicals – SMA, EMA, WMA, RSI, AvgVol

- Historic short interests

- Symbols lookup – all listed symbols in a certain exchange, or all exchanges that list a certain symbol

- Option chains lookup – contract info, in/out of money, trade info, Greeks, implied volatility; grouped by expiration date

- Fundamental info – corporate info, shares stats or bond data, technicals, split/dividend events, ESG scores, earnings, financials

EODML provides a reliable, easy-to-use Matlab interface to EODHistoricalData that works right out of the box, and was optimized for reliability, stability and compatibility.

A free trial is available.

Advanced Matlab programming webinars

- Interactive Matlab GUI (3:26 hours, syllabus)

- Advanced Matlab GUI (3:37 hours, syllabus)

- Expert Matlab GUI (3:33 hours, syllabus)

- Matlab performance tuning part 1 (3:39 hours, syllabus)

- Matlab performance tuning part 2 (3:43 hours, syllabus)

- Object-oriented Matlab programming (3:36 hours, syllabus)

- Real-time trading with Matlab (31 minutes, free)

Downloadable webinar videos and their corresponding slide-decks are provided for an unlimited number of views. The webinars are based on onsite training courses that were presented at multiple client locations. All webinars are highly technical, concise and to the point, making effective use of your time.